Explore how AI-Powered Risk Management is transforming modern risk frameworks with predictive analytics, anomaly detection, NLP insights, and real-time monitoring. Learn key components, benefits, best practices, and the future of AI-driven risk intelligence for enterprises.

AI-Powered Risk Management: Transforming Risk Frameworks for the Next Generation

AI-Powered Risk Management is redefining how organizations identify, assess, and respond to modern risk. In an era where threats evolve faster than traditional systems can detect, enterprises need more than manual assessments and historical models. They need intelligent, predictive, always-on capabilities powered by AI and machine learning.

Today’s risk landscape spans cyber-attacks, financial instability, supply-chain disruptions, regulatory changes, fraud, operational failures, and more. Traditional frameworks—slow, reactive, and dependent on static reports—simply cannot keep pace.

This is why AI-Powered Risk Management has emerged as a strategic necessity rather than a technological luxury.

-

Introduction: The Rise of AI-Powered Risk Management

-

How AI Transforms Traditional Risk Assessment Frameworks

-

From Static to Continuous Monitoring

-

Predictive Analytics

-

Real-Time Anomaly Detection

-

NLP for Risk Insights

-

Dynamic Risk Scoring

-

Cross-Domain Integration

-

-

Key Components of AI-Powered Risk Management

-

Strategic Benefits for Enterprises

-

Real-World Industry Examples

-

Best Practices for Implementing AI in Risk Management

-

Future Outlook

-

Conclusion

In a world where change happens faster than ever, organizations face an escalating array of risks—from cyber‑threats, financial shocks, supply‑chain disruptions, regulatory pressures, to operational failures. Traditional risk assessment frameworks often struggle to keep pace: they rely on manual processes, historical data, limited scenario modelling, and slow feedback loops. Enter AI‑powered risk management: leveraging artificial intelligence (AI) and machine learning (ML) to shift risk management from reactive to proactive, from periodic review to continuous monitoring, from expert‑driven to data‑driven.

Across industries — finance, healthcare, supply chain, cybersecurity and beyond — AI‑driven systems are enabling faster detection of threats, real‑time monitoring of anomalies, predictive modelling of future risks, and better decisionmaking with fewer blind spots. This article explores how AI is reshaping risk management: the key components of an AI‑enabled risk framework, how it enhances predictive analytics, automates risk detection, monitors in real time and supports decision‑making; the strategic benefits for enterprises; real‑world examples; and best practices and future outlook including ethics, explainability and the evolving role of risk professionals.

1. How AI Transforms Traditional Risk Assessment Frameworks

1.1 From static, historical models to dynamic, continuous monitoring

Traditional risk assessments often rely on periodic audits, historical data, predefined risk lists and manual reviews. They tend to be lagging: the risk event has often occurred before it is flagged. With AI, systems ingest large volumes of structured and unstructured data — transaction logs, sensor readings, event feeds, social media, external news — and continuously analyse for emerging patterns, unusual behaviours or deviations. As one consultancy notes, AI enables companies to move from data gathering to information analysis and action. 1.2 Enhanced predictive analytics

Machine learning models can discover non‑linear relationships, hidden variables and subtle signals that traditional regression or rule‑based models may miss. For instance, AI in risk management can do better forecasting accuracy, richer data segmentation and optimized variable selection. By leveraging large datasets, organizations can model “what‑if” scenarios, stress test far‑reaching events, and detect risk trajectories earlier.

1.3 Automating anomaly detection and real‑time alerting

One of the most powerful capabilities is anomaly detection: AI/ML models continuously monitor streams of data (transaction flows, user behaviour, network traffic, supply‑chain signals) and identify deviations or patterns that indicate emerging risk. For example, cybersecurity systems use behavioural analytics to detect insider threats or external breaches.

1.4 Using natural language processing (NLP) for unstructured risk inputs

Much of the risk‑relevant information is buried in unstructured form: news articles, internal emails, social media posts, regulatory disclosures, audit logs. AI systems using NLP can process this data, extract sentiment, detect potential reputational or regulatory issues, and feed them into risk models.

1.5 Continuous decision‑support and real‑time risk scoring

Instead of static risk scores updated quarterly or annually, AI‑powered systems can provide dynamic risk scoring — a risk profile that evolves in real time as new data arrives. This allows decision‑makers to prioritise actions, allocate resources, trigger containment, or escalate issues with greater speed and precision.

1.6 Integration across domains (operational, financial, strategic)

Modern risk management must span operational risks (downtime, process failure), financial risks (market, credit, liquidity), compliance/regulatory risks and strategic risks (reputation, ESG, supply chain). AI enables a unified view across these domains, bringing in diverse data sources and enabling scenario modelling that cuts across risk silos.

2. Key Components of AI‑Powered Risk Management

To build an effective AI‑driven risk framework, several core components are crucial:

2.1 AI‑driven risk scoring

Risk scoring goes beyond traditional checklists. AI systems evaluate multiple dimensions — past behaviour, contextual features, external signals, peer group behaviour, change over time — to assign risk scores. These scores are dynamic and can adjust as inputs change. This gives organisations a more granular and up‑to‑date view of risk exposure.

2.2 Anomaly detection & behavioural analytics

At the heart of detection is the ability to flag what doesn’t fit expected patterns. Behavioral analytics (user, system, network) feed anomaly‑detection models to detect internal fraud, cyber intrusions, operational failures or even supply‑chain disruption. For example, one academic paper on AI‑Driven Insider Risk Management reported a 59 % reduction in false positives and a 30 % improvement in true positive detection by deploying an adaptive neural network‑based system.

2.3 Predictive modelling and scenario simulation

Using historical and real‑time data, ML models forecast risk trajectories (e.g., likelihood of default, supply‑chain disruption, equipment failure). Scenario simulation lets organizations test “what‑if” events (e.g., sudden supplier failure, regulatory change, data breach) and estimate impact, enabling risk mitigation planning ahead of time.

2.4 Natural Language Processing (NLP) for risk insights

NLP tools ingest large amounts of unstructured information — internal documents, regulatory filings, media articles, social mentions — extract entities, sentiment, risk indicators, and feed that into risk systems. A Deloitte analysis notes that around 90 % of corporate‑relevant data is unstructured, making NLP a key enabler.

2.5 Continuous monitoring of operational and financial risk

Operational risks (system outages, process failures, fraud) and financial risks (credit, market, liquidity) require constant vigilance. AI systems monitor signals continuously, alerting when thresholds are crossed, enabling faster response. For instance, risk functions using AI for enterprise risk management report improved ability to identify, measure, monitor and address risks.

2.6 Integration layer & workflow orchestration

Managing risk effectively means linking detection to decision making. AI‑enabled risk systems must integrate with business workflows (e.g., escalation, action tracking, remediation). Automation and orchestration of response (e.g., blocking transaction, triggering audit, shading down exposure) make the system actionable, not just analytical.

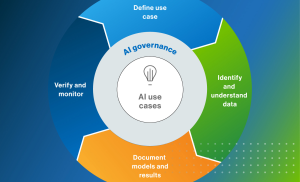

2.7 Governance, explainability & bias management

Using AI in risk means you must also manage the risks of AI: algorithmic bias, model opacity, data quality issues. Frameworks such as ISO/IEC guidelines point to transparency, accountability, traceability.

3. Strategic Benefits for Enterprises

The adoption of AI‑powered risk management delivers a range of strategic advantages:

3.1 Fraud reduction and detection

In finance, banking and insurance, AI systems detect and prevent fraud more effectively than rule‑based systems. For example, banks use machine‑learning models to analyse transactional behaviour, user profiles, peer comparisons to flag suspicious activities This reduces losses, improves customer trust and saves compliance costs.

3.2 Improved regulatory compliance

With increasing regulatory scrutiny (GDPR, CCPA, AML/KYC, ESG disclosures), AI helps organizations monitor compliance continuously, identify potential causes for regulatory scrutiny and generate audit‑ready output. Generative AI, for example, can automate risk‑control self‑assessments and regulatory documentation.

3.3 Minimising operational losses & business continuity

By detecting process anomalies, equipment failures, supply‑chain disruptions early, organizations can reduce downtime, avoid cascading failures and maintain continuity. AI‑powered predictive maintenance is one example: monitoring equipment via sensors to pre‑empt breakdowns.

3.4 Optimised risk‑adjusted decision making

Rather than treating risk as a compliance burden, AI enables organizations to embed risk into strategy — optimizing investments, choosing better risk–reward trade‑offs, moving faster with confidence. Risk becomes a competitive enabler, not a drag.

3.5 Real‑time insights & faster response

Traditional risk functions often operate with lag. AI reduces detection/response cycles significantly. For example, behavioural anomaly systems alert security teams faster; supply‑chain risk forecasters generate early warnings; NLP monitors reputational risk in real time.

3.6 Greater scalability and resource efficiency

Automating data ingestion, monitoring, alerting and analysis means fewer manual human hours, fewer “false positives” to review, and more time for risk professionals to focus on strategic actions. AI helps scale risk functions without proportionate headcount growth.

4. Real‑World Industry Examples

4.1 Finance & Banking

In banking, AI assists with credit scoring, fraud detection, anti‑money laundering (AML) and market risk forecasting. One case study highlighted in research shows how an AI risk management solution improved forecasting accuracy and variable extraction vs older methods.

Generative AI is used for compliance and model documentation. For example, banks use GenAI to draft risk‑control self‑assessments and to synthesise risk positions.

4.2 Health Care

In healthcare, AI offers predictive modelling for adverse events, monitoring patient safety, and detecting anomalies in clinical trials. While more focused research exists in pharma/drug safety, the principles of AI‑driven risk management hold: mining unstructured clinical notes, sensor data and outcomes to flag risk.

4.3 Supply Chain & Manufacturing

Complex global supply chains are vulnerable to myriad disruptions. AI can monitor supplier performance, logistics data, geopolitical events, social media and news feeds for early warning. For example, solutions exist that predict bottlenecks, demand surges or hazards by analysing a wide variety of real‑time data.

4.4 Cybersecurity & Operational Risk

Operational risk and cyber‑risk are major domains for AI risk‑management adoption. AI systems track user behaviour analytics, network logs, insider‑threat patterns, unusual access, process anomalies. These systems evolve as threats evolve, offering continuous monitoring rather than point‑in‑time audits.

4.5 Insurance & Property Risk

Insurance firms are using AI to assess risk at very granular levels—e.g., property risk models that ingest aerial imagery, climate and building data to predict catastrophe risk

5. Best Practices for Integrating AI into Risk Management Systems

5.1 Start small and scale

Rather than trying to retrofit AI across every risk domain simultaneously, choose a high‑impact, feasible use case (e.g., fraud detection, anomaly monitoring) and demonstrate value. Build from there

5.2 Ensure data governance & quality

AI systems rely on large volumes of data; poor quality or biased data undermines performance and introduces risk. Establish standards for data collection, storage, labelling, lineage and auditing.

5.3 Foster cross‑department collaboration

Risk, IT, business operations, compliance need to collaborate. AI risk management touches multiple silos. Shared ownership leads to better outcomes.

5.4 Build explainability & transparency

AI models (especially deep learning) may behave as “black boxes.” For risk management you need Explainable AI (XAI) — the ability to understand model reasoning, interpret outputs, and validate fairness. This is especially critical for regulated industries

5.5 Manage bias, fairness and regulatory compliance

AI models must be checked for bias (e.g., discrimination in credit scoring), fairness, privacy, robustness. Regulatory regimes are evolving (e.g., EU AI Act). Risk teams must guard against new risks introduced by AI itself.

5.6 Integrate governance, monitoring and feedback loops

AI risk systems must include monitoring of model drift (when performance degrades), anomaly feedback, data changes. Establish governance that tracks AI model performance, triggers recalibration and ensures accountability.

5.7 Link risk intelligence to business workflows

Detection is only the beginning. Ensure risk alerts trigger clear actions: escalation paths, remediation tracking, decision support, dashboards and governance oversight.

5.8 Combine human and machine intelligence

AI empowers, but doesn’t replace human judgment. Skilled risk professionals remain critical — interpreting insights, making strategy decisions, applying domain nuance.

6. Future Outlook – What’s Next for AI‑Powered Risk Management

6.1 Greater adoption of Generative AI & large language models (LLMs)

Generative AI is already being applied to risk and compliance: drafting control self‑assessments, summarising huge documents, synthesising risk dashboards, automating compliance workflows

6.2 Explainable, Transparent & Trustworthy AI

As regulators and business stakeholders demand greater accountability, risk‑management AI systems will shift toward transparency, model interpretability, audit trails. Standards bodies like ISO/IEC are already shaping frameworks

6.3 Embedded risk intelligence across ecosystems

Risk management will become more inter‑connected: supply chains, ecosystems of partners, third‑party risks, ESG and climate risk will be more deeply integrated. AI will help model these complex interdependencies and give early warning of cascading risks.

6.4 Ethical & sustainability‑driven risk frameworks

Organizations will increasingly assess not just financial or operational risk, but ethical risk, ESG risk, sustainability risk and reputational risk. AI will play a role in monitoring social media, environmental data, regulatory changes and public sentiment.

6.5 Evolving role of risk professionals

Rather than purely reviewing risk assessments and filling spreadsheets, risk professionals will become “risk orchestration” specialists: interpreting AI‑generated insights, driving strategy, embedding controls into business workflows, ensuring AI‑model governance, and guiding organisational resilience.

6.6 Increased focus on AI risk itself

As AI becomes more pervasive, the risks of AI systems (bias, model drift, vendor concentration, data poisoning) will also become a major focus for risk functions. Indeed, regulators, including the U.S. Treasury, have flagged significant risks from AI in finance

7. Conclusion

AI‑powered risk management is no longer a futuristic concept — it is rapidly becoming a critical foundation of modern enterprise resilience and competitive advantage. By leveraging machine learning, anomaly detection, predictive modelling, natural language processing and continuous monitoring, organizations across finance, healthcare, manufacturing, supply chain and beyond can transform their risk posture from reactive to proactive, from cost centre to value driver.

The benefits are clear: reduced fraud, stronger compliance, lower operational and financial losses, smarter risk‑adjusted decisions and real‑time responsiveness. Yet, success isn’t automatic. Organizations must approach implementation thoughtfully — focusing on data quality, explainability, governance, human + machine collaboration, and linking the insights into actionable workflows.

Looking ahead, as generative AI advances, risk models become more interconnected and embed deeper into business ecosystems, and the role of risk professionals evolves, the organisations that embrace AI‑powered risk management today will be better positioned to thrive tomorrow. At the same time, we must recognize that even as we use AI to manage risk, we must also manage the new risks AI itself introduces — model bias, transparency, vendor concentration, data security.

In short: AI is changing the way we manage risk — but the human element remains essential. Strategy, governance, ethics, domain knowledge and leadership must go hand‑in‑hand with technological capability. In 2025 and beyond, the most resilient organisations will be those that blend advanced AI‑driven risk systems with strong human oversight, robust workflows and adaptive culture.